This article was originally published in CFMA’s Building Profits April 2019

Sometimes financial situations can cause a contractor to fail. But these mishaps can likely be avoided.

Forecasting and managing the timely implementation and execution of cost controls can considerably impact effective bidding. In fact, cost control can form a helpful cyclical pattern that starts at the bid phase, continues through job execution and closeout, and begins again with every new bid.

This article will explore the successful implementation of an all-encompassing cost control at every step within a project’s life cycle.

The Estimate

The first phase of any estimate is establishing bid items. Bid items comprise activities that identify the tasks necessary to accomplish the full construction of an item. Labor, equipment, material, and subcontractor costs are all estimated into these tasks.

There are two schools of thought on the use of activities in an estimate, and successful companies often land somewhere in between. It can be advantageous for the estimator to create unique activities to allow creative brainstorming regarding each step of the process. In contrast, the accounting department usually prefers the estimator to select a preestablished cost code imported from the accounting software that is used every day. The answer to this age-old question between operations and finance on the use of predetermined budget codes in estimating is both “yes” and “no.”

While it may seem easier during the budget stage to have used preestablished cost codes from the accounting software during the estimate phase, a set list of activity or budget codes may not fit all jobs.

The solution may be different for each contractor as to the extent the estimator should use the cost codes from the in-house accounting software. Though, there is one consistent solution where both the estimating and operations teams should agree with the accounting department: the use of standard cost codes.

The consistent use of standard cost codes in the budget – not the estimate – is imperative to develop historical costs, which can then be output by the accounting software to provide the necessary data for an estimator to be successful in future bids.

A standard cost code list tracks every potential construction activity and material purchase that a company can perform or purchase, respectively, for which historical cost is desired. These costs are primarily collected in order to bid the next job using what was learned from the previous one. The lesson here is to bid smarter using historical costs to increase profit.

The Estimate Handoff

Once a project is won and the budget is created using the standard cost code list, then the formal budget should be transferred to the field. This step hands the reins of the project over to the operations side. Welcome to day one of project execution.

For jobs of any magnitude (in contract value and/or complexity), the estimate handoff is a formal meeting in which a time, place, and agenda should be set. The agenda should include an admission of shortfalls, unconservative moves taken to win the job, advantages taken, cash flow strategy, and opportunities for profit growth.

No one knows the job better than the estimator; he or she procured the plans and specifications, visited the site, communicated with the owner, and prepared all costs. During the meeting, the following types of topics and questions should be tailored to the particular job and/or contractor:

Import/Export Materials

• Dump sites – Was a “deal” made at bid time for a location to dump surplus dirt for free?

• Import sources – Can imported rock be provided by another contractor, by a pit outside of our norm, or even as off haul from another one of our own jobs?

• Material changes – Although we bid ductile iron pipe for the water line, would the owner approve using PVC instead?

Cash

• Liquidated damages (LDs) – By project milestones, calendar/working day, or minute

• Unbalanced bid items (cash flow) – The field staff may have to build in the same order as the estimator assumed to collect revenue

• Unbalanced bid items (quantity differences) – A predicted significant underrun or overrun in quantity means increased revenue/profit

Design/Delivery/Insurances

• Design improvements – Your superintendent can “sell” bolted joints instead of thrust blocks, or form savers vs. splicing for concrete reinforcement

• Long lead items – Lead times for procurement of material (valves, shiny metals, and equipment)

• Bonding and/or insurances – Retention bond, builder’s risk (schedule extensions add premium), pollution liability, railroad insurance

The Job Book

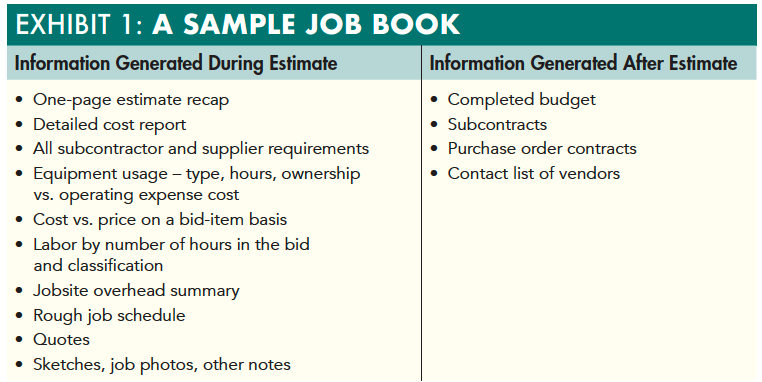

Any responsible foreman or superintendent should insist on a job book, and for good reason. With the advent of the laptop and tablet, the three-ring binder may be going the way of the dinosaur. Regardless of how it is kept, a job book is a priceless tool. A job supervisor should have the entire estimate at his or her disposal in one location for a project’s entire life cycle. The job book is born (see Exhibit 1).

Tips for Field Operations

Once mobilization occurs, the level of financial risk increases. Personnel and equipment are now on the job and when either are idle, money is lost. Be ready to start building by having everything ahead of the field team, including any accounting tools necessary to accurately capture costs.

Tip #1

The first tip to help a project manager is to have a complete budget ready on day one. Without it, the project manager will have no idea what the estimator was thinking at time of bid and will also have no idea what the cost budget is for any of the imminent activities. Ensure the budget is ready no fewer than 10 days before the Notice to Proceed; creating a budget during mobilization can be distracting and can negatively impact the bottom line.

Tip #2

Another time-saver is the inclusion of ready codes. Be ready for changes payable by the owner and back charges to subcontractors or suppliers. A common complaint occurs when a foreman is unable to track extra costs because the appropriate cost code was not set up in time. Avoid this by preloading potential change order and back charge codes. If using a six-digit cost code structure, these codes may be in the 800000 and 900000 families, respectively.

For example, load in five potential change order codes and five back charge codes in the initial budget:

| 800001 800002 800003 800004 800005 |

Extra Work No. 1 Extra Work No. 2 Extra Work No. 3 Extra Work No. 4 Extra Work No. 5 |

900001 900002 900003 900004 900005 |

Back Charge No. 1 Back Charge No. 2 Back Charge No. 3 Back Charge No. 4 Back Charge No. 5 |

Remember to set each of these cost codes up with all cost types, not just labor and equipment.

Tip #3

Encourage field staff to complete timecards, accounts payable (A/P) and subcontractor approvals in a timely manner. The importance of developing efficient habits in these actions cannot be overstated. Beginning with the first week, require timecards on a certain day by a certain time. The timecards are often the easiest.

Many contractors pay their foremen an extra half-hour per day for completing their timecard daily, but none really enforce it. Consider issuing your foremen two checks: one for their weekly hours worked, and a second for each day the timecard was completed within 24 hours. When the employee (or the spouse) sees the weekly check for only two each half-hour payments for the completion of timecards twice that week, you may soon see the timecards coming in every day.

The more pressing challenges are receiving weekly A/P and monthly subcontract payment approvals. Perhaps offer an incentive such as the project manager who returns the approved costs back first wins a small gift card and companywide e-mail recognition!

Tip #4

The accounting department should encourage access to the accounting, and in particular, access to all job cost reports and the forecasting module. Ideally, project management field staff should have access to these modules so that they are held accountable for the necessary reporting.

Cost Forecasting

Cost forecasting forms the critical backbone of a company’s success. Knowing how to accurately predict the profitability of a project through its lifespan instills confidence in lenders (i.e., surety and bank) and offers a company stronger growth opportunity.

The ability to forecast the end profit on a project is both an art and a science. The artistic portion lies in knowing the work and the challenges that may come and how to estimate them. The scientific part involves knowing the timing of posted costs and how to derive a recipe for earned quantities during the construction.

As with the other cost reporting discussed previously, “muscle memory” can be achieved with regularity. Engrain within your field management that cost-to-complete reports are due monthly. Leadership should ensure a quarterly, surety-ready work-in-progress (WIP). If a company decides to mandate costs-to-complete from the field on a monthly basis, there needs to be assistance from the back office. This assistance can come in the way of a published schedule of posting of costs, and adherence to this schedule. Clearly communicate to the field when costs will be posted for labor, A/P, equipment, and subcontractor.

To avoid further complicating the process of predicting final cost, a good practice is to close the month by the 15th and have the projections done by the 20th. Figure out what works, publish it, and live by it.

Labor is likely the most consistent cost in the report. Since payroll is often processed weekly or biweekly, these costs can hit the report like clockwork. However, consider the following nuances:

• Does your labor include hidden costs?

• Do you embed more than straight tax and fringe in the hourly rate?

• How does your company handle general liability, bonus, small tools, workers’ comp, and corporate overhead?

If these costs beyond pure labor are in your posted labor costs, then they need to be published to your field team.

Knowing the value of a manhour is not only important to accurately predict the remaining labor cost on the project, but it is also crucial to reduce “double dipping.” This comes up frequently with general liability, which is often bid and budgeted as a line item cost. The problem can arise in overallocating cost; for example, committing the full cost of this insurance on a line item while the controller had decided to pay it within the labor rate since the policy with the carrier was based on labor. There’s no right or wrong way to do it, it’s just a necessary transparency to ensure accuracy.

The best way to accurately predict equipment’s effect on the job cost is to publish how the accounting department recognizes these costs. This message to the field team must cover two critical components: 1) the timing of the expense to the job, and 2) the manner in which the cost is assessed to the projects.

Often, project managers can complete projections only for a potentially significant cost to hit the bottom of the report in a code called “Equipment Allocation.” This unpredictable action by the controller can come as a surprise to the project manager, thus wildly swaying the projection of final cost.

Moreover, without a published schedule of the timing of these expenses and the rates of the equipment being charged to the project, the field staff can end up taking their equipment business to outside vendors rather than pay high in-house rates that are billed on an unpredictable schedule.

Subcontractor costs can be some of the cleanest costs in the system. Regardless of when, simply including committed costs makes this an easy projection. Generally speaking, a committed cost equal to the subcontract value leaves only the calculation of back charges or extras payable by the client. Understating or ignoring any potential back charges is a conservative, recommended approach as it can only increase the gross profit.

Tax, such as on gross revenue, is another challenging aspect that can appear in the job cost report and on the income statement as a cost of goods sold and be forecast by the field team, or be handled in the back office and excluded from the job cost report altogether.

Again, transparency is the key. Consider including it as a line item in the cost report so that the project manager has the responsibility of accruing it and therefore will have a full understanding of the total cost of the project. He or she will then have the responsibility and be further educated on the true cost of the work – making him or her stronger in change order negotiation as well as in estimating work.

An internal operating procedure can effectively handle the prediction of claims costs. It’s helpful for the project team to know what governs in cost reporting on claims (likely GAAP) so that accuracy can be maximized. If the project managers know what your reporting standard is, then they can provide the numbers needed to share with the surety.

With regard to performing cost-to-completes or forecasts, developing the means and methods to execute these calculations should be considered. As a company grows, it can be increasingly difficult to maintain consistency.

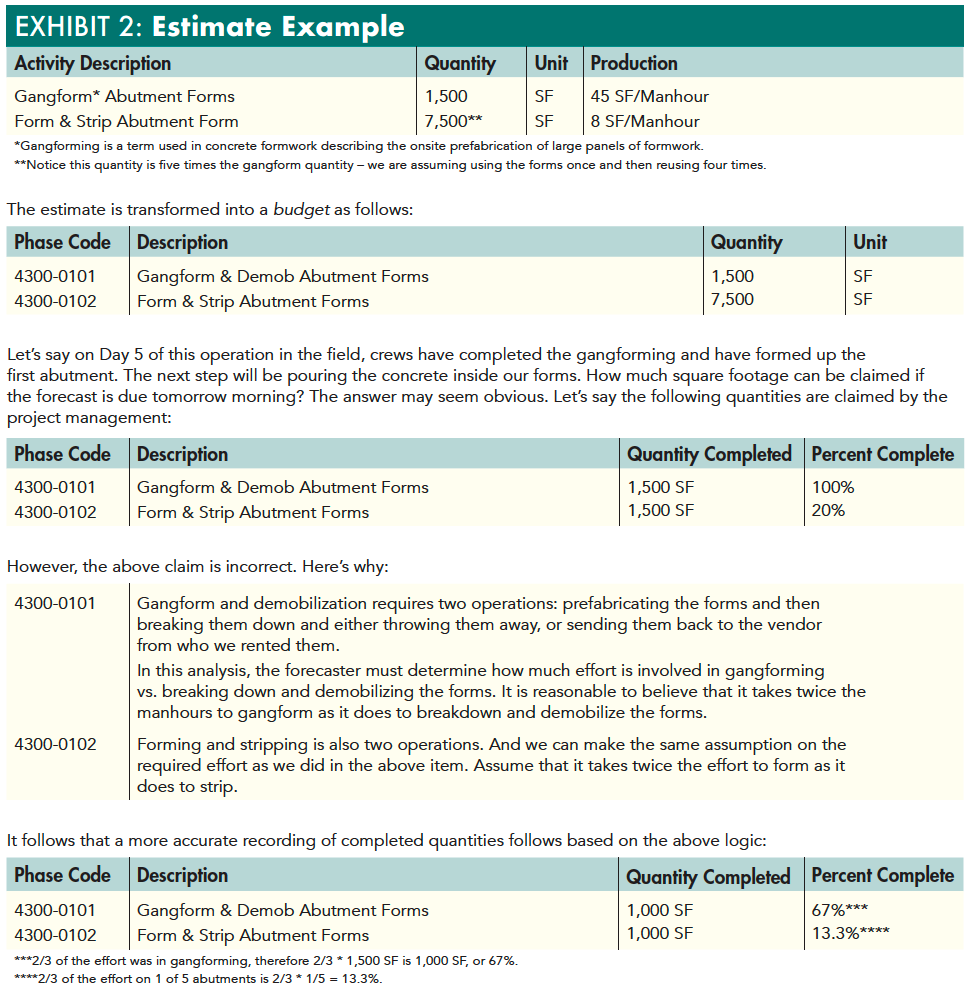

A quick lesson by the accounting department on matching principle is in order. The part of forecasting that the accountants will need from the construction professionals is the manner in which to record percent completion. Take for example the forming of a bridge abutment – this is the part of the bridge upon which the beams sit. Exhibit 2 presents an example of the activities and productions of an estimate.

Conclusion

This proposed set of discrete controls is meant to provide either instant improvement in cost controlling, or the necessary checks in future cost control. Implementing all or some can assist contractors in achieving better accuracy in bidding work, managing work, and forecasting final cost. Consider making a change or two immediately in the hope that a year down the road a change in habit here or there can aid in making healthy cost control a regular part of your business.

0 Comments