Executive Summary. If you’ve ever wondered how bonding capacity is earned and calculated, it may be a bit fuzzier than you think. But it does rely on numbers. Read on for the basics.

What is bonding? You’ve heard people say “The job is bonded.” or “How much can they bond?” or “They’ll call the bond”. This begs the understanding of what exactly a bond is. A bond is an insurance. It’s an insurance for, usually, a Project Owner. A bond is a piece of paper that says “If the contractor fails, the company named on this piece of paper will step in an fix all of the problems caused by the contractor.” Usually that company named to fix the problem(s) is a name you’ve heard: Liberty Mutual, Travelers, Hartford, Zurich, AIG, et cetera.

Let’s just pick Liberty Mutual for my examples below.

What are the types of bonds in construction? There are three common types of bonds in construction: bid bond, performance and payment bond, and labor and material bond. As stated above, if there is any problem with the bid, the contract performance or payment to subcontractors, or labor and material payments, Liberty Mutual will step in and hire a new general contractor and/or make payments, or whatever cures the issue.

Is it like auto insurance? If your question is “Since bonding is an insurance, is there a deductible for the general contractor and certain rules on coverage?” The answer: nope, not even close. There is no deductible. The Owner simply calls up Liberty Mutual and says “My project’s general contractor is in trouble, please come out and fix my problem.” The next step is Liberty Mutual places a call to the general contractor and if there is no immediate resolution, Liberty Mutual starts paying bills or hiring a new contractor, or both.

How do I get bonding? There’s a saying in the bonding world that bonding capacity is based on the Three C’s: character, capacity, and capital. It’s very true. Character will get you the initial meetings with the sureties (surety and bond are basically synonymous), capacity has to do with the controls a contractor has in place and if they can handle the additional work, and lastly capital is pretty much just cash.

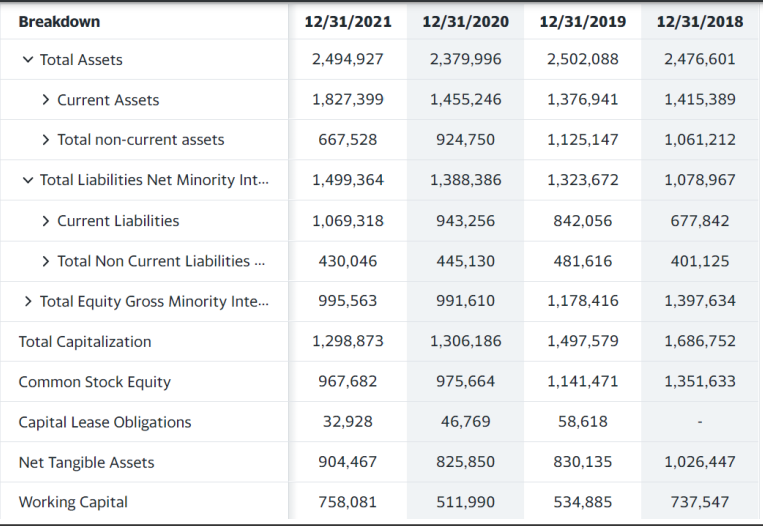

How is bonding capacity calculated? Once you have the character and capacity established as described in the prior paragraph, then it comes down to capital, or cash. It’s a balance sheet calculation. A contractor’s balance sheet is a financial document prepared by your accountant which shows the company’s financial conditional at a moment in time. Below are Granite Construction’s year over year balance sheets from Yahoo! Finance:

Bonding capacity as calculated by a surety is usually done in one of two ways: by working capital or by net worth.

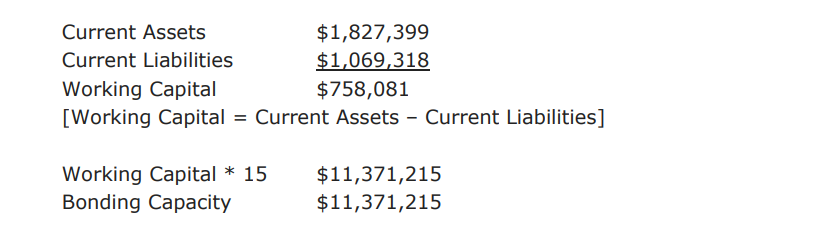

If by working capital, then the working capital is calculated and then multiplied by a number, like 10 or 20. So, taking the balance sheet above (and let’s assume that the balance sheet is NOT in thousands), the working capital is calculated:

There is no exact science to any of this. The Three C’s and the calculation above (the working capital, the multiplier of 15, et cetera) are all done on “feel” by the surety based on your surety agent’s opinion of you and his/her ability to “sell you” to the surety.

If you do a net worth calculation (instead of the working capital one), the process is similar. Above, the net worth is Total Assets minus Total Liabilities, or $995,563. Again, another multiplier is chosen

How do I get bonding capacity for my new construction business? If you’re just starting out your construction business, it’s pretty simple. You need to get an introduction to a surety agent and then you need to have cash. Cash solves a lot of problems.

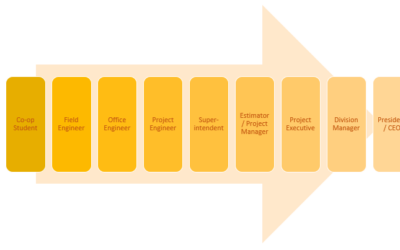

My story. I was a project manager for a growing construction business and I always talked with their surety agent. So, when I went out on my own I had a surety contact. Then I gathered money from my parents and my own savings account and threw it in a business bank account. Voila! Bonding capacity!

Work Safe!

0 Comments